How to Apply for Citibank SMRT Credit Card Step-by-Step Guide

Exploring the Citibank SMRT Credit Card Benefits

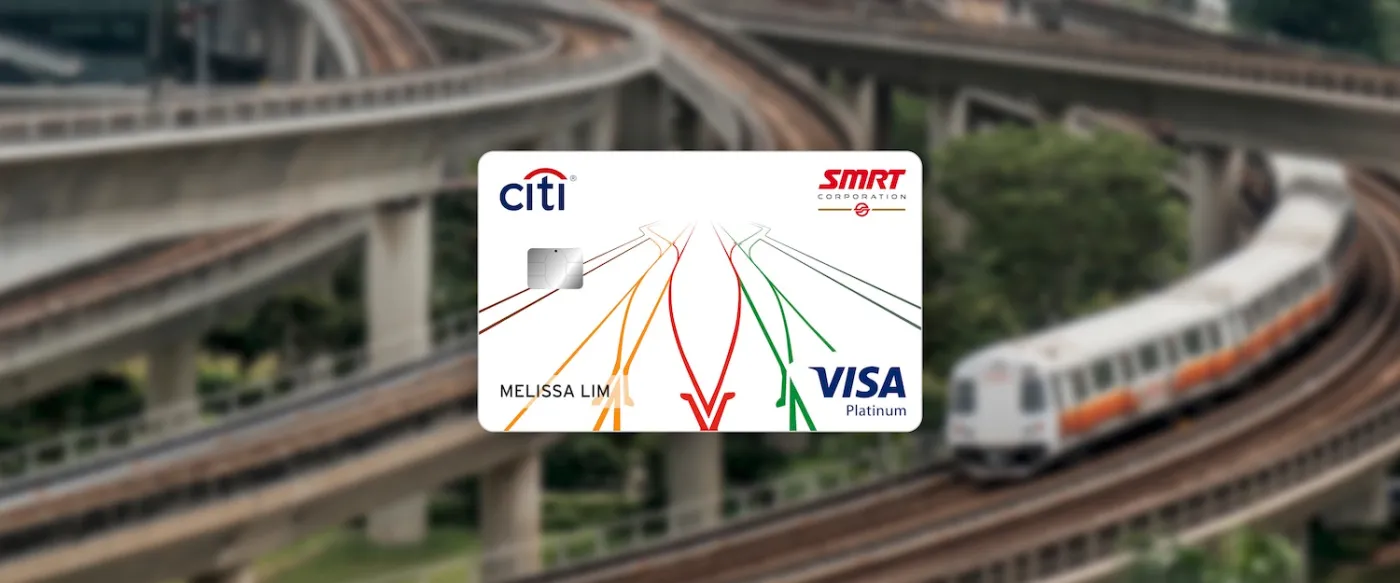

The Citibank SMRT Credit Card is a financial tool tailored to complement the lifestyle of Singaporeans, particularly those who are keen on maximizing their routine expenditures. A key feature of this card is its remarkable cashback incentives on everyday expenses. Specifically, cardholders can enjoy cashback on public transport journeys, a significant savings opportunity given Singapore’s comprehensive transit network. Additionally, the card offers generous cashback on grocery shopping and online purchases, areas where Singaporeans frequently spend a substantial portion of their monthly budget.

Financial Advantages

One of the main reasons to consider the Citibank SMRT Credit Card is its potential to optimize personal finances. By accumulating cashback, users effectively reduce their overall expenditure, translating into tangible savings over time. This card grants users a seamless blend of convenience and rewards, proving to be a practical choice for those engaging in frequent daily transactions.

Accessibility and Simplicity

The card’s low annual fee ensures that it is accessible to a wide demographic, including young professionals who are budget-conscious and savvy shoppers looking for value. Moreover, the applicability and straightforwardness of its features mean that cardholders can easily integrate its use into their financial routines. The application process for the Citibank SMRT Credit Card is particularly user-friendly, designed to be straightforward and quick to facilitate easier access.

Detailed Application Process

For prospective applicants, understanding the steps involved is crucial to leveraging the card’s benefits effectively. The process typically involves a few key stages: completing an online form, submitting necessary documentation such as proof of income and identification, and awaiting approval from the bank. Once approved, cardholders can immediately start using the card to make purchases that qualify for cashback. This step-by-step integration of the card into your wallet can significantly enhance your everyday financial habits, ensuring that you continuously derive benefits from your spending activities.

In summary, the Citibank SMRT Credit Card is more than just a payment tool; it’s a strategic asset for enhancing financial efficiency. Whether you’re commuting, shopping for groceries, or browsing online stores, this card is designed to provide you with the best value for your everyday expenses in Singapore.

Benefits of Citibank SMRT Credit Card

1. Impressive Cashback Rewards

The Citibank SMRT Credit Card offers a competitive cashback program that allows you to earn up to 5% cashback on a variety of everyday expenses, including groceries, online shopping, and public transport rides within Singapore. This benefit makes it an ideal choice for individuals looking to maximize savings on recurring expenditures.

Tip: To make the most of this benefit, ensure you meet the minimum monthly spend requirement to qualify for the highest cashback rate.

2. Convenient Rebate Redemption

This credit card provides a straightforward and hassle-free process for redeeming the cashback you accumulate. The cashback earned is automatically credited to your account, allowing for an uncomplicated and beneficial savings experience.

Tip: Regularly track your cashback balance through the Citibank online banking or mobile app to stay informed of your savings.

3. Utilities and Bill Payment Savings

With the Citibank SMRT Credit Card, you can enjoy rebates on recurring utility and telecommunications bills. This benefit is particularly advantageous given the rising costs of essential services, making it a strategic choice for budget-conscious consumers.

Tip: Use your card for as many of your family’s utility payments as possible to optimize your savings.

4. Comprehensive Shopping Protection

When using the Citibank SMRT Credit Card for purchases, you gain the advantage of various shopping protection features, including purchase protection and extended warranty benefits. These features provide peace of mind for both everyday buys and big-ticket items.

Tip: Familiarize yourself with the terms of these protections to understand how they apply to your purchases and make the most of them.

VISIT THE WEBSITE TO LEARN MORE

| Category | Key Features | Advantages | Requirements | Ideal Users |

|---|---|---|---|---|

| Cashback Offers | Earn 5% cashback on selected categories. | Maximizes savings on everyday spending. | Requires good credit score. | Frequent shoppers on these categories. |

| Travel Benefits | Exclusive deals and discounts on travel bookings. | Cost-effective travel options for cardholders. | Minimum income requirements apply. | Travel enthusiasts and frequent flyers. |

| Flexible Payment Options | Installment plans with low-interest rates. | Improves financial flexibility for large purchases. | Certain eligibility criteria must be met. | Those with significant expenses. |

| User-Friendly Mobile App | Manage all transactions and rewards from your device. | Enhances convenience and tracking. | Available for all cardholders. | Tech-savvy individuals. |

Requirements for Applying for the Citibank SMRT Credit Card

- Minimum Age: Applicants must be at least 21 years old. This is a standard requirement for credit card applications in Singapore, ensuring that the applicant has reached the age of majority and is legally capable of entering into a contractual agreement.

- Income Criteria: For Singapore Citizens and Permanent Residents, a minimum annual income of S$30,000 is required. Foreigners need to demonstrate a higher minimum annual income of S$42,000 to qualify for the Citibank SMRT Credit Card.

- Residency Status: The card is available for Singapore Citizens, Permanent Residents, and Foreigners residing in Singapore, provided they meet the income requirements stated above.

- Credit Score: A positive credit history is essential. Applicants with a good credit score are more likely to be approved. Citibank reviews credit scores to assess the risk and creditworthiness of each applicant.

- Required Documentation: Recent income documents such as payslips, CPF statements, or Income Tax Notice of Assessment. Foreigners must also submit a copy of their passport and work permit.

VISIT THE WEBSITE TO LEARN MORE

How to Apply for the Citibank SMRT Credit Card

Step 1: Visit the Official Citibank Singapore Website

Begin your application process by accessing the official Citibank Singapore website. Navigate to the Credit Cards section and locate the Citibank SMRT Credit Card option. This credit card is renowned for offering cashback and rewards on various transactions, making it an attractive choice for consumers in Singapore.

Step 2: Review Eligibility Criteria

Ensure that you meet the eligibility criteria before initiating the application. Generally, applicants should be at least 21 years old. Singapore Citizens or Permanent Residents need to have a minimum annual income of SGD 30,000, while foreign applicants require a minimum annual income of SGD 42,000. Having these prerequisites will expedite the application process.

Step 3: Gather Necessary Documents

Collect all required documents to streamline your application. Essential documents include your NRIC or passport, the latest computerized payslips, and CPF statement or tax returns for income verification. If you’re self-employed, prepare your Notice of Assessment and company’s financials. Ensuring these are on hand will facilitate a hassle-free submission.

Step 4: Complete the Online Application Form

Complete the online application form by providing your personal details, employment information, and financial particulars. Take care to input accurate data to avoid delays or rejections. Once the form is filled, submit it for processing. Citibank may contact you for further verification or additional information if needed.

Step 5: Await Approval and Notification

After submission, Citibank typically takes several working days to process the application. Upon approval, you will receive an official communication from Citibank confirming your credit card issuance. If there are any discrepancies or documents pending, the bank will contact you directly for resolution.

LEARN MORE DETAILS ABOUT CITIBANK SMRT

Frequently Asked Questions about Citibank SMRT Credit Card

What are the key benefits of the Citibank SMRT Credit Card?

The Citibank SMRT Credit Card offers various benefits, including cashback on everyday purchases such as groceries, dining, and public transport. Cardholders enjoy up to 5% cashback on selected spending categories, making it an attractive option for those looking to maximize savings on daily expenses.

Are there any annual fees associated with the Citibank SMRT Credit Card?

Yes, the Citibank SMRT Credit Card has an annual fee of SGD 192.60. However, this fee is waived for the first year. Subsequent annual fees can be waived upon spending a minimum of SGD 10,000 in the preceding year, making it feasible for regular spenders to avoid this cost.

How does the cashback system work for the Citibank SMRT Credit Card?

The cashback system on the Citibank SMRT Credit Card works by providing cardholders with a percentage of their spending back in the form of cashback. It offers 5% cashback on groceries, 3% on dining at cafes, fast food, and movies, and 2% on public transport rides. The cashback is calculated monthly and awarded as SMRT$ which can be used to offset future purchases.

Is the Citibank SMRT Credit Card suitable for online shopping?

Yes, the Citibank SMRT Credit Card is suitable for online shopping as it provides up to 3% cashback on online purchases with a minimum spend requirement. Cardholders can optimize savings by combining in-store and online spend to meet the qualifying conditions for enhanced cashback rates.

What is the eligibility criteria for applying for the Citibank SMRT Credit Card?

To be eligible for the Citibank SMRT Credit Card, applicants must be at least 21 years old. Singapore citizens and Permanent Residents require a minimum annual income of SGD 30,000, while foreigners need to earn at least SGD 42,000 annually. These requirements ensure that cardholders are financially capable of managing the credit responsibly.

Related posts:

How to Apply for Citibank M1 Credit Card Step-by-Step Guide

How to Apply for a Citibank Business Credit Card Step-by-Step Guide

How to Apply for the UOB EVOL Credit Card Step-by-Step Guide

Apply for OCBC Easicredit Easy Steps to Get Your Loan Approved

Apply for the OCBC 90N Credit Card Quick Easy Guide

How to Apply for Best-OCBC Credit Card Step-by-Step Guide

Beatriz Johnson is a seasoned financial analyst and writer with a passion for simplifying the complexities of economics and finance. With over a decade of experience in the industry, she specializes in topics like personal finance, investment strategies, and global economic trends. Through her work, Beatriz empowers readers to make informed financial decisions and stay ahead in the ever-changing economic landscape.