How to Apply for Citibank Cash Back Plus Credit Card Easy Steps

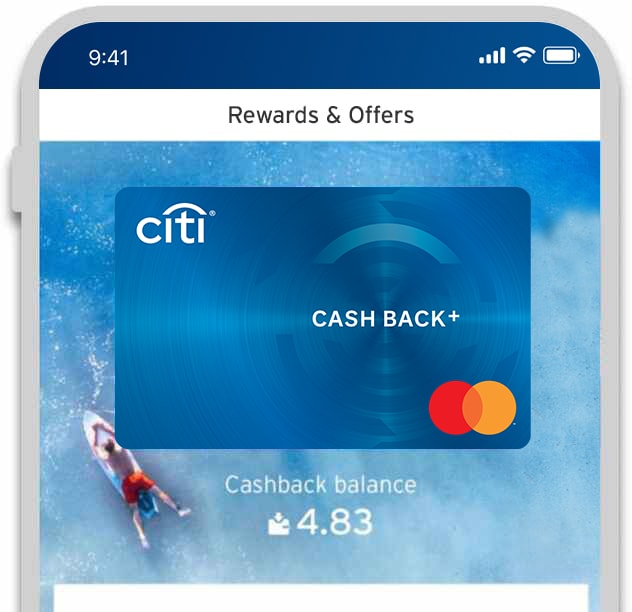

Unlocking Financial Benefits with the Citibank Cash Back Plus Credit Card

For the discerning Singaporean spender, the Citibank Cash Back Plus Credit Card presents an unmatched opportunity to enhance everyday financial management. This credit card is designed with the savvy consumer in mind, offering generous cashback rewards on a wide range of purchases. Whether you are shopping for groceries, dining out, or paying bills, this card ensures you are rewarded for every dollar spent.

No Annual Fee and Hassle-Free Applications

One of the most compelling features of the Citibank Cash Back Plus Credit Card is its no annual fee for the first year. This allows users to experience the card’s comprehensive benefits without the usual financial commitment. This is particularly appealing to new cardholders in Singapore who wish to explore credit card perks without the burden of additional costs.

The application process is straightforward, designed to be user-friendly. Even those unfamiliar with credit card applications will find the steps clear and manageable, opening up the card’s benefits to a wider audience. This accessible approach ensures that financial planning and management can be a reality for more individuals.

Maximizing Rewards in Daily Transactions

The real advantage of this card lies in its ability to turn everyday expenditures into significant savings. Users can maximize their financial strategy by taking full advantage of the cashback rewards on common spending categories prevalent in Singapore, such as public transportation, dining, and digital services. The card effectively transforms regular payments into a rewarding financial experience.

By carefully selecting their credit cards to match their spending habits, Singaporeans can significantly boost their savings. Therefore, exploring the multitude of rewards and benefits that the Citibank Cash Back Plus Credit Card offers is essential for anyone seeking to optimize their financial resources while enjoying superior service quality.

Benefits of Citibank Cash Back Plus

1. Uncapped 1.6% Cash Back on All Purchases

The Citibank Cash Back Plus card offers a competitive and straightforward cash back rate of 1.6% on all purchases. Unlike many other credit cards that impose limits or specific categories, this benefit applies universally to all spending. This makes it easier for cardholders to maximize their rewards without adjusting their spending habits. To make the most out of this benefit, consider using the card for everyday expenses like groceries, dining, and utilities.

2. No Minimum Spend Requirements

Unlike many other credit cards that require a certain amount of spending to qualify for cash back, the Citibank Cash Back Plus card features no minimum spend requirements. This allows for flexibility and enables even low-volume spenders to enjoy rewards. For optimal cash back accrual, consider planning your expenses in advance to consolidate purchases on this card.

3. Complimentary Travel Insurance

Cardholders can enjoy a sense of security while traveling with complimentary travel insurance provided when flights and travel packages are booked using the Citibank Cash Back Plus card. This benefit covers travel-related contingencies such as trip cancellations or medical emergencies. Before traveling, ensure to book through recommended partners to activate this insurance coverage effectively.

4. Global Acceptance and Additional Privileges

The Citibank Cash Back Plus card is widely accepted both locally and internationally, making it convenient for those who travel frequently. Additionally, cardholders have access to exclusive privileges such as dining discounts and promotional offers worldwide. For maximum savings, keep an eye on ongoing promotions and partner deals to coincide larger expenses with these offers.

LEARN MORE DETAILS ABOUT CITIBANK CASH BACK PLUS

| Cash Back Rewards | Unlimited Earnings | No Annual Fee | Introductory Offers |

|---|---|---|---|

| 1% Cash Back on All Purchases | Earn on Every Transaction | Enjoy Savings Every Year | Attractive Intro Offers Available |

| Bonus Cash Back on Specific Categories | Easy to Maximize Rewards | No Hidden Fees | Limited-Time Promotions |

| Flexible Redemption Options | Convert Rewards to Cash | Ideal for Everyday Users | Early Access to Bonuses |

| No Minimum Redemption Amount | Access Rewards Anytime | Cost-Effective for Students | Great for New Cardholders |

The Citibank Cash Back Plus Mastercard offers a straightforward way to earn cash back on everyday purchases. Unsurprisingly, its key strengths include flexibility in rewards, eliminating annual fees, and the appeal of ongoing promotional offers. The card is designed for those seeking simplicity and enhanced savings with every transaction, encouraging a wider audience to take advantage of its straightforward cash-back program.

Requirements to Apply for the Citibank Cash Back Plus Credit Card in Singapore

- Minimum Income: For Singapore Citizens and Permanent Residents, a minimum annual income of S$30,000 is required. For foreigners residing in Singapore, an annual income of at least S$42,000 is necessary to qualify for the Citibank Cash Back Plus Credit Card.

- Age Requirement: Applicants must be at least 21 years old at the time of application to be eligible.

- Credit Score: A good credit score is essential; Citibank typically favors applicants with a solid credit history, which demonstrates financial responsibility.

- Documentation: Singapore Citizens and Permanent Residents need to provide their NRIC and latest computerized payslip. Foreigners require a valid passport, work pass, and proof of income such as a bank statement or tax return.

- Employment Tenure: Generally, a stable employment history of at least six months in the current job is preferred, reflecting stable income.

GET YOUR CITIBANK CASH BACK PLUS THROUGH THE WEBSITE

How to Apply for the Citibank Cash Back Plus Credit Card

Step 1: Visit the Official Citibank Website

To initiate the application for the Citibank Cash Back Plus credit card, begin by navigating to the official Citibank Singapore website. You can do this by entering the URL www.citibank.com.sg into your web browser. Once on the homepage, look for the credit cards section to gain access to a comprehensive list of available credit card options.

Step 2: Select the Citibank Cash Back Plus Option

Upon finding the credit card products, locate the Citibank Cash Back Plus credit card. Click on the card to view detailed information about its features, benefits, and associated terms and conditions. It is advisable to thoroughly review all details to ensure the card meets your financial needs and preferences.

Step 3: Complete the Application Form

Click on the application link to proceed with the process. You will be required to fill out an online application form. This form generally requires personal information such as your full name, contact details, employment information, and income levels. Ensure all provided information is accurate to avoid processing delays.

Step 4: Submit Necessary Documentation

After completing the application form, prepare to submit the requisite supporting documents. Typically, this includes identity verification (such as NRIC or passport), income proof (such as payslips or a Notice of Assessment), and address verification. These documents can often be uploaded directly through the Citibank portal for your convenience.

Step 5: Await Approval Notification

After your application and documents have been submitted, Citibank will assess your application. Approval timelines can vary, but it typically takes a few working days. You will receive a notification regarding the status of your application via email or phone call as per the contact details provided.

LEARN MORE DETAILS ABOUT CITIBANK CASH BACK PLUS

Frequently Asked Questions about the Citibank Cash Back Plus Credit Card

What are the key benefits of the Citibank Cash Back Plus Credit Card?

The Citibank Cash Back Plus Credit Card offers a flat cash back rate on all eligible purchases without any cap. Cardholders earn 1.6% unlimited cash back on their spending globally, which provides excellent value for those who frequently use their credit card for varied expenses. There are no restrictions on the categories or locations for earning this cash back. Additionally, the card features no annual fee, further enhancing its appeal to consumers seeking a cost-effective option.

Are there any fees associated with the Citibank Cash Back Plus Credit Card that I should be aware of?

While the Citibank Cash Back Plus Credit Card does not have an annual fee, certain charges may still apply. Foreign currency transactions incur a fee of up to 3.253% of the transacted amount. Balance transfers, cash advances, and late payment fees are other charges that may apply, depending on the usage and payment behavior. It is advisable for cardholders to review the detailed fee structure provided by Citibank Singapore to understand how these charges may impact them.

How can I redeem the cash back earned through this credit card?

The cash back earned with the Citibank Cash Back Plus Credit Card is automatically credited to your account as a statement credit on a monthly basis, requiring no minimum redemption threshold. This hassle-free redemption process ensures that cardholders benefit from their accumulated rewards without the need for additional steps or transactions.

Can the Citibank Cash Back Plus Credit Card be used internationally?

Yes, the Citibank Cash Back Plus Credit Card is accepted worldwide wherever the Mastercard network is operational. Cardholders can earn the same 1.6% cash back on qualifying purchases internationally as they would domestically. However, users should be mindful of foreign transaction fees that apply when using the card outside of Singapore.

Is there a minimum income requirement to apply for the Citibank Cash Back Plus Credit Card?

Yes, to qualify for the Citibank Cash Back Plus Credit Card, individuals must meet the minimum income requirement as set by Citibank Singapore. For Singaporeans and Permanent Residents, the minimum annual income requirement is SGD 30,000, while for foreigners, it is SGD 42,000. Meeting these criteria is essential to be considered eligible for this credit card offering.

Related posts:

How to Apply for an HSBC Advance Credit Card A Step-by-Step Guide

How to Apply for the OCBC VOYAGE Credit Card A Step-by-Step Guide

How to Apply for a Citibank Cash Back Credit Card Step-by-Step Guide

How to Apply for Citibank M1 Credit Card Step-by-Step Guide

How to Apply for the OCBC Rewards Credit Card Step-by-Step Guide

How to Apply for Best-OCBC Credit Card Step-by-Step Guide

Beatriz Johnson is a seasoned financial analyst and writer with a passion for simplifying the complexities of economics and finance. With over a decade of experience in the industry, she specializes in topics like personal finance, investment strategies, and global economic trends. Through her work, Beatriz empowers readers to make informed financial decisions and stay ahead in the ever-changing economic landscape.