How to Easily Apply for the Monzo Flex Credit Card Today

Unlock Greater Financial Flexibility with the Monzo Flex Credit Card

For UK residents venturing for enhanced financial flexibility, the Monzo Flex Credit Card offers a promising and modern solution. As a pioneering option tailored for the contemporary consumer, this card merges technology and convenience beautifully, serving to meet the dynamic needs of today’s fast-paced lifestyle. The highlight is its structure of no upfront fees and versatile payment choices, making it stand out in a saturated market.

Seamless Payment Options at Your Fingertips

Monzo Flex empowers you to manage your purchases by spreading payments over 3, 6, or 12 months, providing essential breathing space for your budget. Whether you’re planning for a significant investment like a new appliance or accommodating a spontaneous trip, these options ensure that financial strain is minimized. This strategic payment approach makes Monzo Flex an attractive proposition for those who are keen on gaining control over their spending without immediate pressure.

User Experience Reinvented

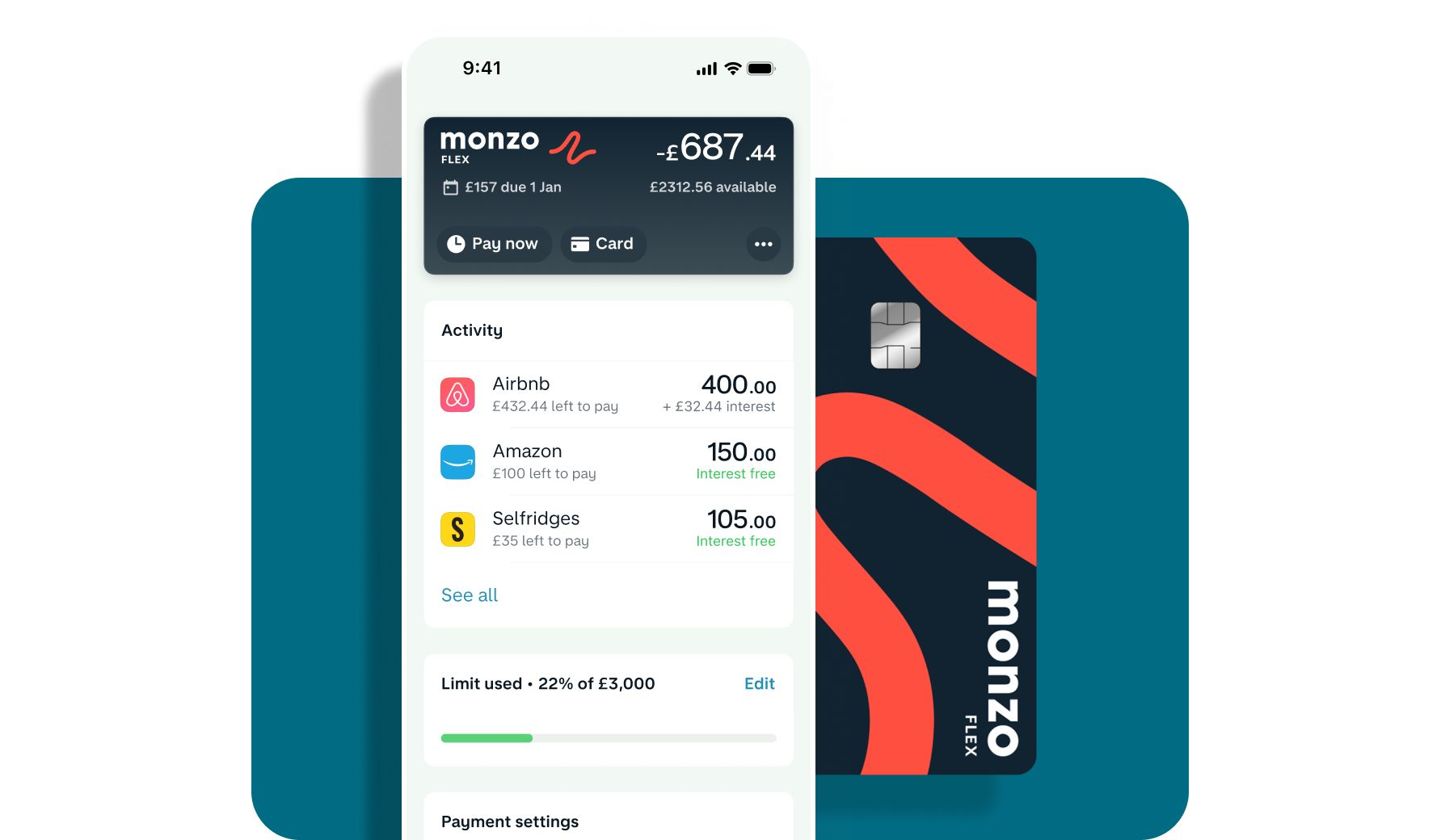

Embodying a user-friendly ethos, Monzo Flex leverages Monzo’s acclaimed application to the full. The app allows users to handle their accounts effortlessly and intuitively from their smartphones, offering an array of features such as quick applications, real-time spending insights, and budget tracking. These tools ensure you remain informed and proactive about your financial health, thus empowering smarter spending decisions.

An Essential Financial Tool

Whether you’re navigating through life’s larger purchases or simply managing everyday costs, the Monzo Flex Credit Card serves as an indispensable tool in any financial toolkit. By offering real-time insights and flexible options, it not only supports better budget management but also encourages a more informed approach to credit usage. Discover how embracing this innovative service can revolutionize your financial habits and contribute to a more structured spending strategy.

Explore what Monzo Flex can do for you and consider how its features align with your financial goals. It might just be the change needed to streamline your approach to credit and spending, offering a modern solution in a digitized age. From setting customized alerts for upcoming payments to tracking your spending categories, Monzo promises functionality that aligns seamlessly with contemporary financial needs.

Unlocking the Key Benefits of the Monzo Flex Credit Card

1. Flexible Payment Options

The Monzo Flex Credit Card is all about giving you the flexibility to manage your finances your way. With its unique offering, you can spread the cost of purchases over three months, completely interest-free. This means no rush to pay off a balance with crippling interest rates. For longer plans of up to 12 months, competitive interest rates apply, enabling you to balance the advantage of installment payments against potential costs.

2. Accessibility and Convenience

Monzo Flex integrates seamlessly with the Monzo app, putting financial management at your fingertips. Keep track of spending, schedule payments, and get real-time notifications, all within a user-friendly interface. The blend of physical card usage and the digital wallet ensures you are always ready for your next purchase.

3. Transparent Costs and No Fees

One of the standout benefits of the Monzo Flex Credit Card is its transparency. Say goodbye to hidden fees and unexpected charges. With Monzo Flex, you’ll know exactly what you are paying for, with detailed breakdowns available in the app. No annual fees and up-front information about interest and repayment terms put you in control.

4. Improving Your Credit Score

The Monzo Flex Credit Card can be a valuable tool in building or improving your credit score. By consistently making your payments on time, you demonstrate responsible credit usage, which can positively impact your credit rating. Regularly using Monzo Flex and keeping up with payments can support your financial health in the long term.

SIGN UP FOR YOUR MONZO FLEX CREDIT CARD TODAY

Key Requirements for Monzo Flex Credit Card

- The applicant must be aged 18 or over to be eligible for the Monzo Flex Credit Card. This is a standard practice across financial products in the UK.

- A good credit score is essential. Monzo typically requires a credit score that reflects responsible previous borrowing. While they are open to assessing individual circumstances, a higher score increases your chances of approval.

- Applicants must have a UK bank account and be able to verify this with appropriate documentation. This helps verify identity and ensures seamless transactions.

- It’s necessary to provide details of your annual income and employment status. While Monzo might not specify a minimum income threshold, demonstrating a stable financial situation is crucial for approval.

- A valid photo ID, such as a UK passport or driver’s license, is required for identity verification during the application process.

- Finally, while you don’t need to be an existing Monzo customer, having a Monzo account could streamline the application process for the Flex Credit Card.

SIGN UP FOR YOUR MONZO FLEX CREDIT CARD TODAY

How to Apply for the Monzo Flex Credit Card

Step 1: Visit the Monzo Website

To begin your journey towards financial flexibility, head over to the Monzo website. From the homepage, navigate to the Monzo Flex Credit Card section. Here, you’ll find all the information you need about the card’s features, benefits, and terms. This platform is your gateway to learning how Monzo Flex adapts to your financial lifestyle.

Step 2: Check Eligibility

Before you apply, it’s crucial to ensure you meet the eligibility criteria. Typically, applicants must be at least 18 years old and a UK resident. Having a good credit history will bolster your chances. To verify if you fit the profile, Monzo provides a simple checker tool—fill in basic information, and you’ll quickly know if you can proceed.

Step 3: Start the Online Application

Once eligibility is confirmed, it’s time to start your online application. Fill out the form with your personal, financial, and employment details. Fortunately, Monzo has streamlined this process for user-friendliness, ensuring you’re not bogged down by unnecessary paperwork.

Step 4: Verification Process

After submitting your application, Monzo will carry out the necessary verification checks. This includes a critical credit assessment and an identity confirmation. While this might sound complex, Monzo’s efficient systems usually make it a swift experience, often giving you updates within hours.

Step 5: Receive Approval and Credit Card

Upon successful completion of the verification process, you will receive an approval notification. Your Monzo Flex Credit Card will then be mailed to your address. From activation, enjoy the convenient and flexible financial solutions tailored to suit your lifestyle needs.

SIGN UP FOR YOUR MONZO FLEX CREDIT CARD TODAY

Frequently Asked Questions about the Monzo Flex Credit Card

What is the Monzo Flex Credit Card?

The Monzo Flex Credit Card is a unique offering from Monzo, designed to provide financial flexibility through a “buy now, pay later” model. Unlike traditional credit cards, it allows users to split purchases into manageable instalments. This means you can opt to pay for anything over £30 in 3, 6, or 12 instalments, making budgeting easier and more predictable.

How does interest work on the Monzo Flex Credit Card?

Interest on the Monzo Flex Credit Card can vary depending on the plan you select. Choosing to pay in 3 instalments is interest-free, offering a cost-effective option for short-term borrowing. However, longer-term plans such as the 6 or 12 instalment options will incur an interest charge. It’s important to note that the interest rate can vary based on individual credit assessments, so be sure to check the rates offered in your personalized Monzo app.

Are there any fees associated with the Monzo Flex Credit Card?

One of the attractive features of the Monzo Flex Credit Card is the absence of fees for missed or late payments. This stands in contrast to many traditional credit card offerings. That said, always pay attention to the interest rates, as they can affect the total cost if opting for longer repayment terms.

How does Monzo Flex affect my credit score?

Using Monzo Flex responsibly can have a positive impact on your credit score. Regular, on-time payments demonstrate good credit behavior, which credit agencies look favorably upon. However, like all credit products, late or missed payments can negatively affect your credit score. It’s advisable to use the card within your means and maintain a budget to ensure timely payments.

Related posts:

How to avoid credit card debt and maintain good financial control

How to Apply for HSBC Purchase Plus Credit Card Easy Steps Tips

The Impact of Credit Card Interest Rates on Consumer Financial Health

How to Apply for the Barclaycard Avios Credit Card Step-by-Step Guide

Strategies to Avoid Credit Card Debt

The Effects of Excessive Use of Credit Cards on Personal Debt

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.